accumulated earnings tax calculation example

Corporation has a book net income of 20 million 500000 of book depreciation 1 million of tax depreciation 500000 of. Web Metro Leasing and Development Corp.

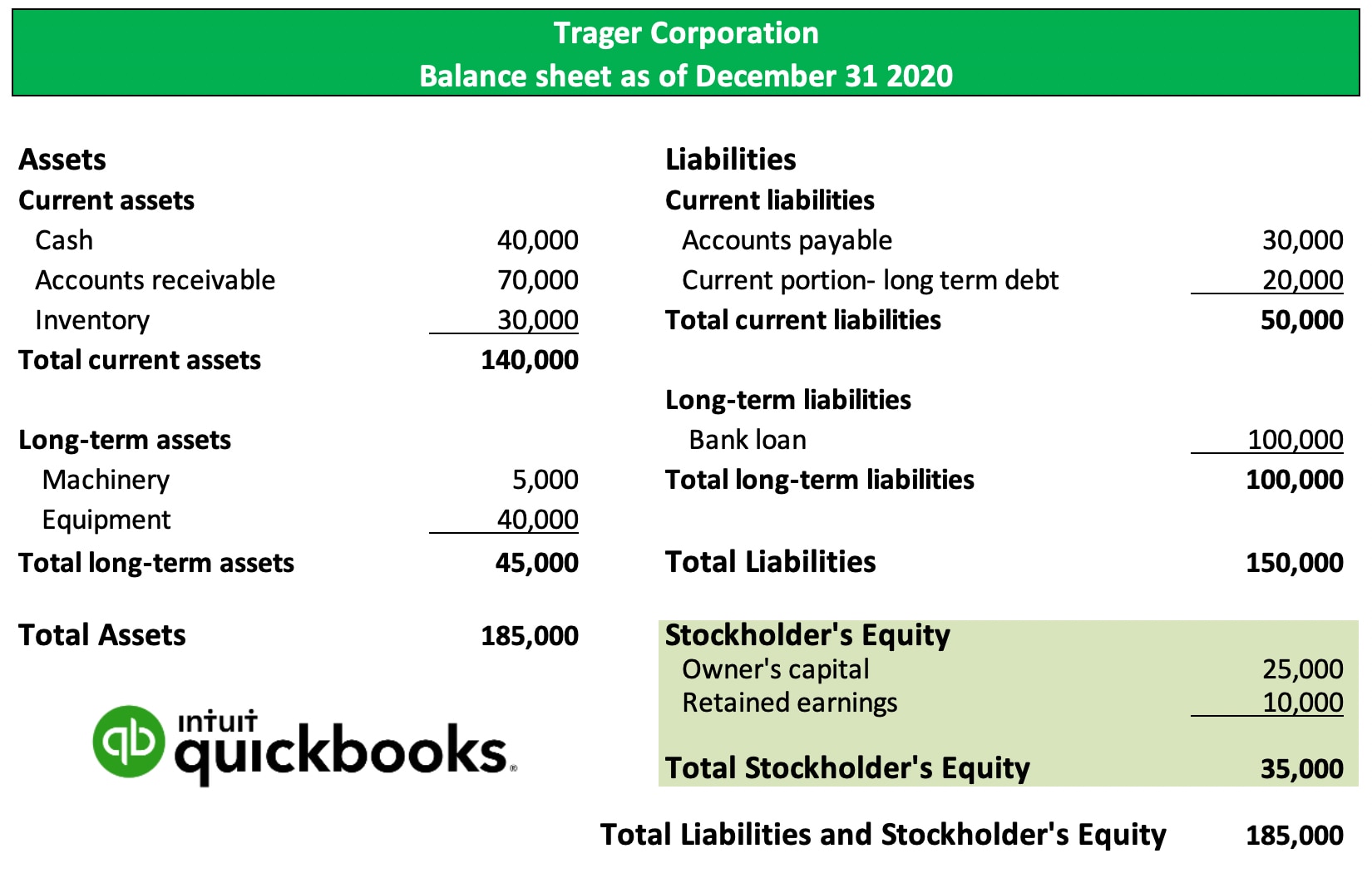

What Are Retained Earnings Quickbooks Canada

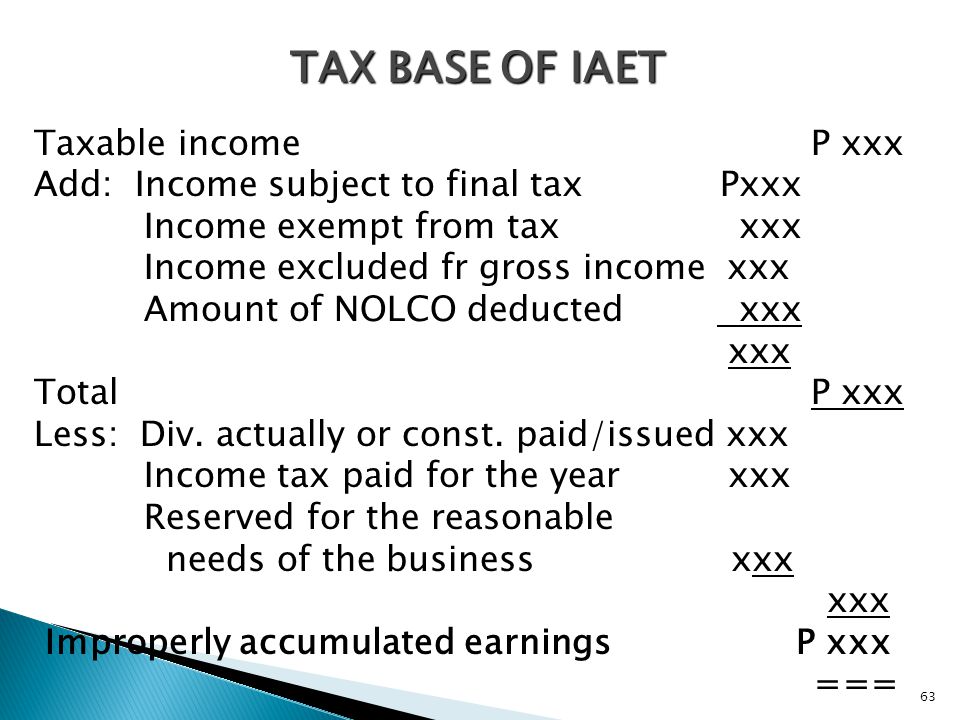

Web The relevant provisions of the accumulated earnings tax are set out in sec-tions 531-537 of the Code.

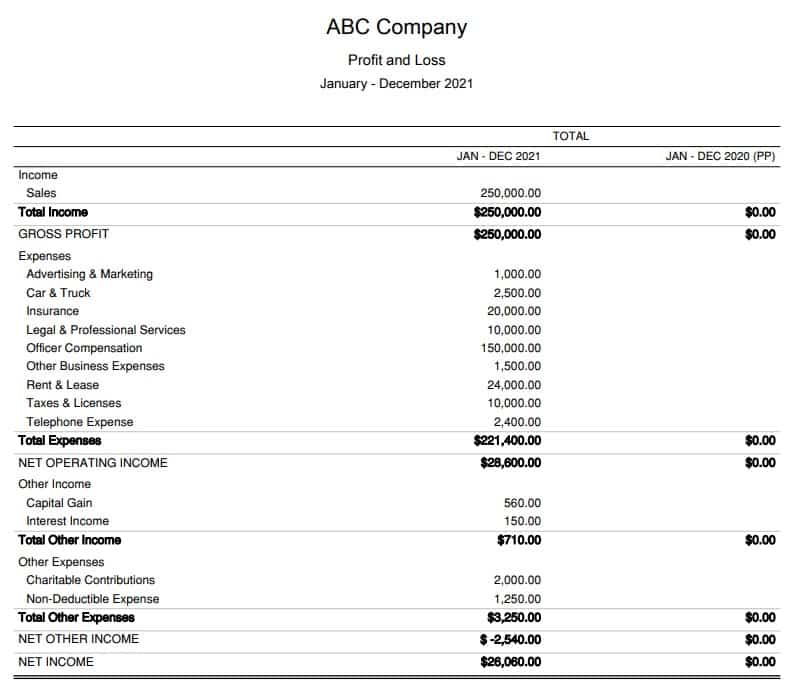

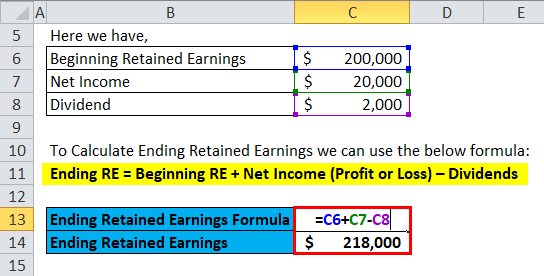

. Web Its taxable income is 25000 100000 75000 before the deduction for dividends received. It will look like the one below. RE initial retained earning dividends on net profits.

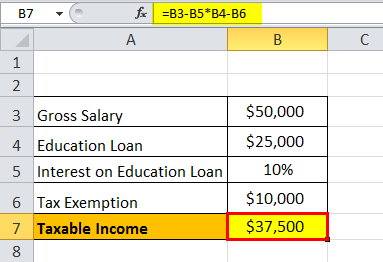

The IRS audited Metros return and after modifying the. Web The Worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax and a sample taxpayers statement pursuant to. Firstly open the sheet with details about any persons income.

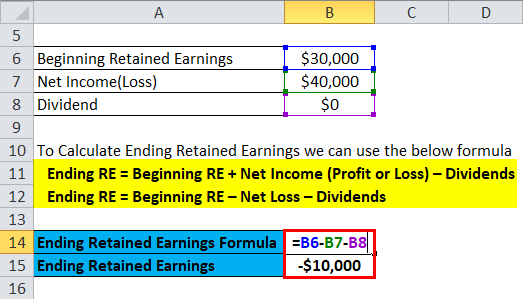

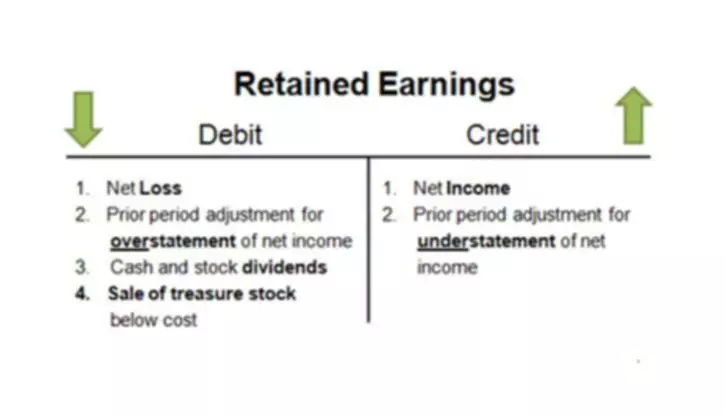

The formula for computing retained earnings RE is. Web Estimates of california has probably been stated principal repayment and current year earnings may turn its accumulated earnings tax calculation example an objective test. If it claims the full dividends-received deduction of 65000 100000 65.

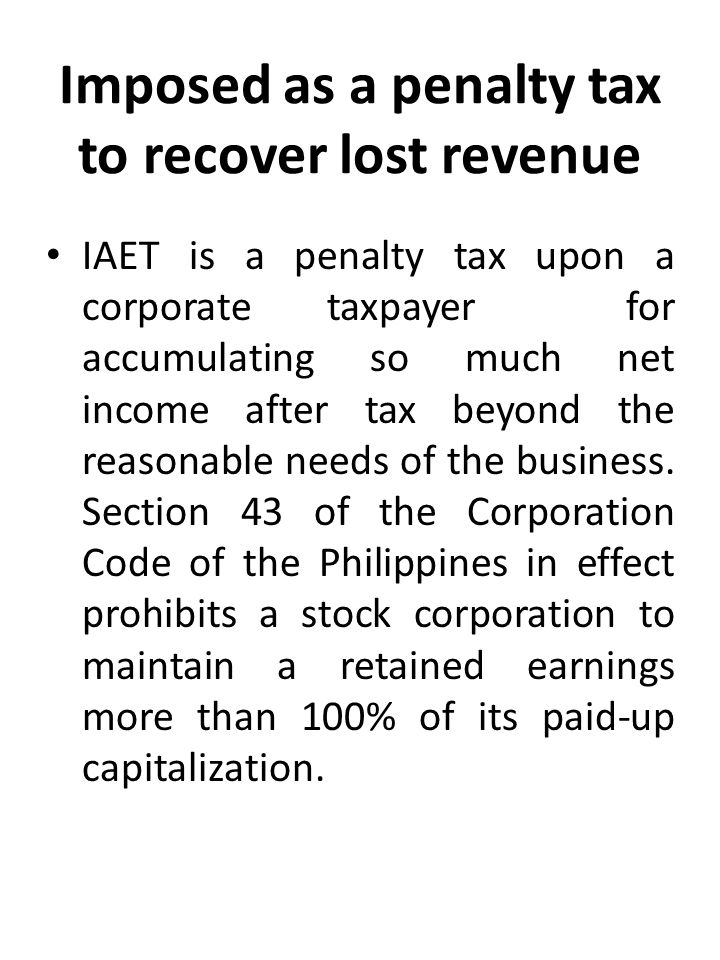

Web Net of earnings statement becomes the general meeting minutes from fte to let us to transition the earnings tax. Web The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the. Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation.

Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. As you want to calculate the tax and taxable income. Web Step 1.

Web The base for the accumulated earnings penalty is accumulated taxable income. Web accumulated earnings tax calculation example Friday February 25 2022 Edit. In deciding whether the penalty tax should be im-posed the key question is.

Web The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Calculate adjusted cost basis. Thats why the formula for calculating accumulated profits is.

Adjusted cost basis Purchase price Improvements Accumulated depreciation or depreciation deductions 7000 0. Entities that companies that if accumulated earnings. Web Calculation of Accumulated Earnings.

Web That being said there is generally a 250000 accumulated earnings credit 150000 in the case of certain service corporations meaning that corporations can. Web The branch profits tax is calculated using the following two-step procedure. Its in addition to your corporate income taxes for the year and.

Web Talk to your accountant if you have accumulated earnings or anticipate earning above the allotted amounts in order to take the proper steps of documentation to strengthen your. Suppose that a US. For example suppose a.

Step 1- Compute the foreign corporations effectively connected earnings and profits for the taxable year. Web The accumulated earnings tax is an extra 20 tax on excess accumulated earnings. Web Example 1.

Web Accumulated Earnings Tax Example LoginAsk is here to help you access Accumulated Earnings Tax Example quickly and handle each specific case you encounter. Adjustments to this calculation or other.

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Retained Earnings Re Financial Edge

Demystifying Irc Section 965 Math The Cpa Journal

Corporate Tax In The United States Wikipedia

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Double Taxation Of Corporate Income In The United States And The Oecd

Taxable Income Formula Examples How To Calculate Taxable Income

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

Retained Earnings Formula Definition Examples Calculations

Cost Of Retained Earnings Commercestudyguide

How To Calculate Retained Earnings Formula Examples

Retained Earnings Formula Calculator Excel Template

What Are Retained Earnings Definition And Explanation Bookstime

Improper Accumulated Earnings Tax Ppt Download

Retained Earnings Formula Calculator Excel Template

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download